Why does American healthcare cost so much? Why does a trip to the ER feel like you’re buying a used Lexus you never wanted? Clearly, something is broken. And like most things broken in this country, we keep duct-taping it together instead of actually fixing it.

Reform should accomplish two two very simple things:

- Provide more healthcare to the people who need it

- Make it cost less than your mortgage

Sounds easy, right? Let’s see why it’s not.

The Problem

To fix healthcare costs, you first need to understand why they’re skyrocketing. Spoiler alert: Most lawmakers and most doctors couldn’t explain it either. Neither of these groups have a very good understanding of healthcare economics or facility reimbursement.

I will give you an example:

Let’s meet “Fred” (not his real name, because who remembers names when you’re elbow-deep in someone’s liver?). Fred strolled into my ER with a perforated liver and hemorrhagic shock—basically, dying. He had no insurance. Normally, we’d stabilize uninsured patients and ship them off to a not-for-profit that eats the costs. But Fred was hours from death, so transfer = death. Surgery it was.

Two ICU days, a pharmacy’s worth of antibiotics, and a week on the nursing floor later, Fred walked out alive. His bill? A modest $95,000. Fred’s payment? A modest zero. We billed him, collections chased him, lawyers tried, and poof—Fred disappeared into the Arkansas night.

This is what hospitals politely call “uncompensated care.” Translation: working for free while hemorrhaging money. For most hospitals, this is their third-highest expense, right after “paying staff” and “keeping the lights on.” Sometimes 40% of total costs are just… patients like Fred.

So what do hospitals do? They raise prices. Dollar-for-dollar, baby. Bad debt up 14%? This equals rates up 14%. No magic, no negotiation, just inflation on autopilot.

Here’s the vicious cycle, simplified:

- People can’t pay → hospitals raise rates.

- Insurance companies pay the higher rates → they raise premiums.

- Employers and individuals foot the bill → everyone complains, but nothing changes.

- The end result is → We all pay Fred’s bill one way or another.

Congrats! You’re paying Fred’s $95,000 tab whether you knew it or not.

This is the vicious cycle of healthcare inflation.

Don’t you see? This affects everything.

Don’t you see? This affects everything.

Socialism, But Make It Expensive

Here’s the kicker: we already have socialized healthcare. Not the kind with free checkups and happy doctors like Scandinavia. No, our version is sneakier: those who pay are covering those who can’t. But instead of being efficient, we do it through bankruptcy courts, insurance premiums, and 28% APR credit cards. It’s like socialism, but wrapped in a capitalist fever dream.

****************Read this section carefully***************

Total “uncompensated care” in America? About $400 billion a year. Over a decade, that’s $4,000,000,000,000 (yes that’s trillion). That’s right: we’ve been lighting money on fire for 50 years while arguing over who’s holding the match.

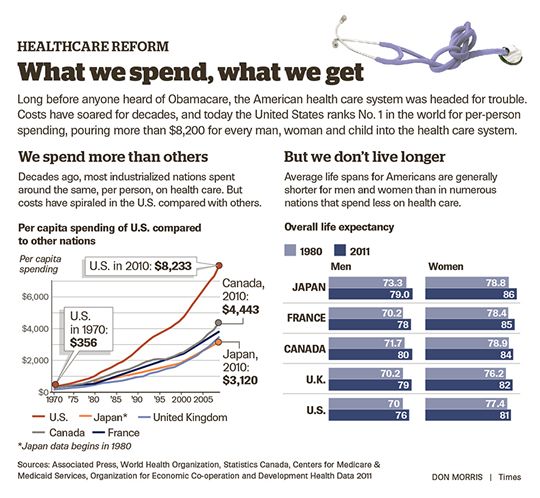

This is why healthcare costs have increased by an average of 12% a year for the last 20 years – three times faster than wages over the same period.

THIS IS WHY PEOPLE CAN NO LONGER AFFORD THEIR INSURANCE PREMIUMS!

********************************************************

So there you have it. We had “socialized” healthcare all along and we didn’t even know it. Those who can & will, pay for those who can’t & won’t. It is pure income redistribution. Some say socialism doesn’t work. They are right. It hasn’t worked in American healthcare in the last 50 years.

So there you have it. We had “socialized” healthcare all along and we didn’t even know it. Those who can & will, pay for those who can’t & won’t. It is pure income redistribution. Some say socialism doesn’t work. They are right. It hasn’t worked in American healthcare in the last 50 years.

Want to reduce costs? Easy. Get rid of bad debts.

But how?

The Solution (Yes, There Actually Is One)

So what’s the fix? Brace yourself: Universal Coverage.

If Fred had insurance, his bill would’ve been paid. Hospitals wouldn’t jack up prices. Insurance companies wouldn’t jack up premiums (at least not as much). Patients wouldn’t drown in debt. The cycle slows down. Everyone wins—except maybe bankruptcy lawyers.

“But I can’t afford insurance!” you cry. Fair point. The family plan that cost $210/month in 1989 now costs $1,640/month—because apparently healthcare premiums age like wine, except nobody’s enjoying the taste.

Still, the math works. If we slow premium growth to less than wage growth, eventually affordability catches up. It’s like running a marathon—except instead of getting a medal at the end, you just get to see a doctor without selling a kidney on Craigslist.

Universal coverage doesn’t eliminate personal responsibility—it actually enforces it. Everyone pays something. No more Freds skipping out. No more hidden socialism where working families bankroll the uninsured.

The Reality Check

Will America embrace a single-payer system like the rest of the developed world? Probably not. We’re too busy screaming about “government control” while happily letting private insurance companies dictate what medications we can take. Irony, thy name is Blue Cross.

But the truth is clear: universal coverage works. Other countries do it cheaper, with better outcomes. The question isn’t can we do it—it’s whether we’ll stop yelling long enough to actually make the decision.

Until then, enjoy paying Fred’s bill.